-

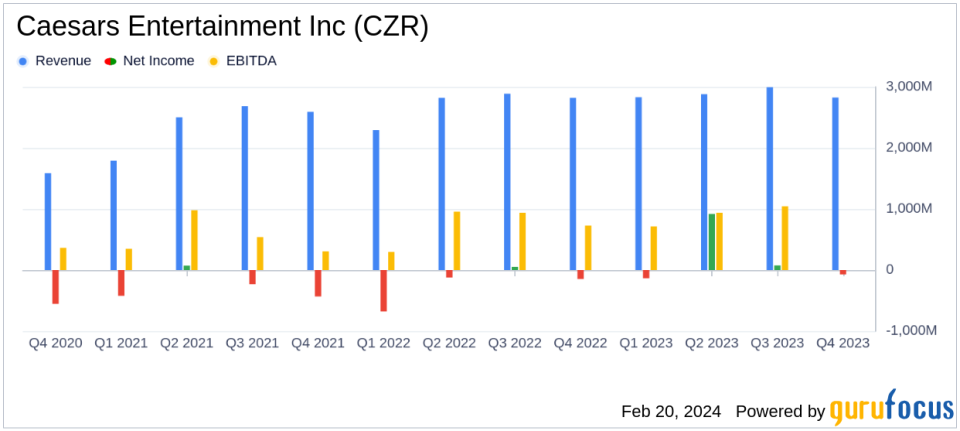

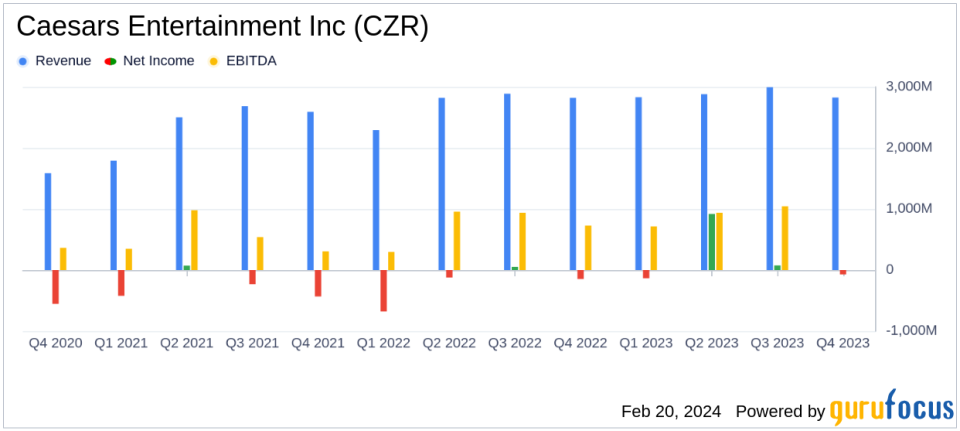

revenue: Increased from $10.8 billion in the previous year to $11.5 billion.

-

Net income: Significant year-over-year change from net loss of $899 million to net income of $786 million.

-

Adjusted EBITDA: Full-year same-store adjusted EBITDA increased from $3.2 billion to $3.9 billion.

-

caesars digital: Adjusted EBITDA turned positive at $38 million, a significant improvement from the loss ($666 million).

-

debt reduction: Since the 2020 merger, more than $3 billion in debt has been permanently repaid and is expected to continue to be reduced in 2024.

-

lever action: Total net leverage under the Bank Credit Facility decreased to 3.9x as of December 31, 2023.

On February 20, 2024, Caesars Entertainment, Inc. (NASDAQ:CZR) released its 8-K filing detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company operates about 50 gaming facilities in the country, and the U.S. division of digital sports betting platform William Hill reported a slight increase in GAAP net revenue in the fourth quarter, compared with $2.82 billion in the year-ago period. In comparison, it reported that it reached $2.83 billion. Net loss significantly decreased to $72 million from $148 million in the year-ago period.

For the full year, Caesars Entertainment (NASDAQ:CZR)'s GAAP net revenue increased 6.5%, from $10.8 billion to $11.5 billion. The company achieved a remarkable turnaround in GAAP net income of $786 million, compared to the prior year's net loss of $899 million. Full-year same-store adjusted EBITDA was $3.9 billion, up from $3.2 billion, demonstrating strong operating results.

Financial highlights and challenges

The company's Caesars Digital division showed notable improvement, with adjusted EBITDA of $38 million for the year, compared to a loss of $666 million a year ago. This growth is significant as it reflects the company's strategic focus on expanding its presence in digital and online gaming, which is becoming increasingly important in the competitive travel and leisure industry.

However, the company still faces challenges, with same-store adjusted EBITDA declining slightly to $930 million in the fourth quarter from $949 million in the year-ago quarter. This may indicate potential problems in maintaining growth momentum in the highly competitive gaming and entertainment market.

Debt management and liquidity

Caesars Entertainment (NASDAQ:CZR) reported a strong balance sheet with $12.4 billion in total debt and $1.0 billion in cash and cash equivalents, excluding $138 million in restricted cash. The company's aggressive debt management was highlighted by CFO Brett Junker's comments:

Our fourth quarter operating results demonstrated increased consolidated net revenue, decreased net loss, and stable consolidated adjusted EBITDA compared to the same period last year. Results were driven by Caesars Digital's 28% year-over-year increase in net revenue and adjusted EBITDA margin of 10% in the quarter. Full-year results benefited from Caesars Digital's net revenue increasing 78% to approximately $1 billion and the segment's adjusted EBITDA improving by more than $700 million.

The company's commitment to debt reduction is clear, with more than $3 billion of debt permanently repaid since the merger in 2020, and the company is focused on further debt reduction in 2024. The refinancing, which was completed on February 6, allowed the company to repay all outstanding debt in 2025 and extend the repayment deadline. The maturity date will be closest to July 2027, reducing total net leverage to 3.9x as of December 31, 2023.

I'm looking forward to

Caesars Entertainment Inc (NASDAQ:CZR) remains focused on building value for guests through a combination of service, operational excellence and technology leadership. With a focus on its Caesars Rewards loyalty program and its commitment to corporate social responsibility, the company is poised to continue its trajectory of growth and debt reduction next year.

Investors and interested parties are invited to attend the company's conference call on February 20, 2024 to discuss the results in more detail by visiting the Investor Information section of Caesars Entertainment's website. I was invited.

For a comprehensive understanding of Caesars Entertainment Inc (NASDAQ:CZR)'s financial performance, including detailed financial statements and reconciliation of GAAP and non-GAAP measures, we recommend viewing the entire 8-K filing .

For more information, please see the full 8-K earnings release from Caesars Entertainment Inc here.

This article first appeared on GuruFocus.