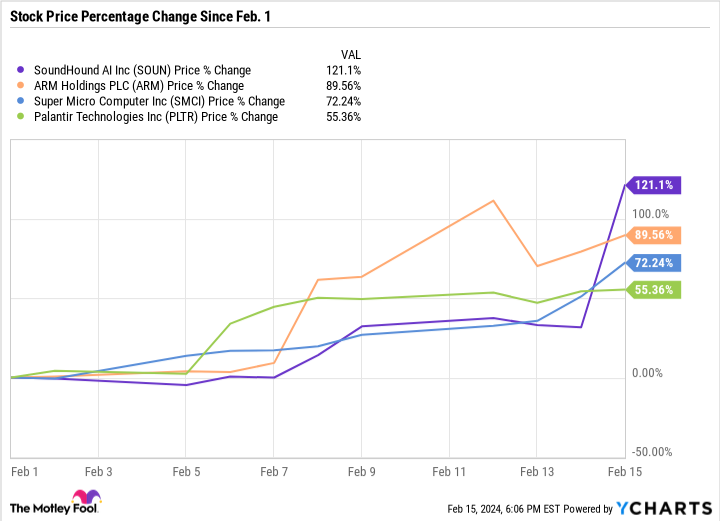

The rapid adoption of artificial intelligence (AI) has gained momentum over the past year, and recent weeks have seen a significant increase in AI-related developments. Even just after the beginning of February, Palantir Technologies (NYSE:PLTR) Jumped 55%, super microcomputer (NASDAQ:SMCI) soared 72%, arm holdings (NASDAQ:ARM) Soared 90%, Soundhound AI (NASDAQ: SOUN) It had soared 121% as of Thursday's market close.

What these companies have in common is accelerated adoption of AI. There was no single event that drove these stocks higher, but rather the rising wave of AI that is starting to overtake the tech industry.

Let's take a look at why each of these stocks has risen and what it means for the future.

show me the money

It wasn't just The long-term tailwind of generative AI has strengthened, driving these stocks higher. Three of the four companies recently reported quarterly results that easily beat investors' expectations.

Supermicro opened its doors first, reporting results for its second quarter of fiscal 2024 (ending December 31, 2023). The company's revenue was $3.7 billion, up 103% year over year and 73% sequentially. Management cited its track record and accelerating demand for AI servers. Earnings were equally impressive, with adjusted earnings per share (EPS) increasing 62% to $5.59. If that wasn't enough, the company is projecting full-year revenue of $14.5 billion at the midpoint of its guidance, which equates to 100% growth for him.

Next up was Palantir Technologies. Fourth-quarter revenue was $608 million, up 20% year-over-year and 9% sequentially, driven by a 70% increase in U.S. commercial revenue. This performance gave the company five consecutive quarters of profit under generally accepted accounting principles (GAAP), with adjusted EPS of $0.08.The headline was the following prediction at least Thanks to strong demand for Palantir's generative AI solution, an artificial intelligence platform, its U.S. commercial business is expected to grow 40% over the next year.

Most recently, Arm Holdings achieved some impressive results. In the third quarter of 2024, Arm generated record revenue of $824 million, an increase of 14% year-over-year, driven by license revenue up 18% and record royalty revenue up 11%. . This performance resulted in adjusted EPS of $0.29, an increase of 32%. It was the company's forecast that really caught Wall Street off guard. Management expects fourth-quarter sales to be in the range of $850 million to $900 million, or a growth rate of 34% to 42%, exceeding his 14% growth rate in the third quarter. is shown.

What these companies have in common, aside from the obvious connection to AI, is that each company delivered a “beat-and-raise” quarter that defied expectations, with guidance exceeding Wall Street's already bullish expectations. provided.

The godfather of AI evaluates

There is a strong argument that Nvidia We saw the writing on the wall and braced ourselves for the coming AI boom. Investors need only look at the company's recent performance to understand the magnitude of the long-term tailwinds associated with it.

For Nvidia's fiscal third quarter of 2024 (ending October 29, 2023), the company achieved the following results: record Revenue increased 206% to $18.1 billion, and diluted EPS increased 1,274% to $3.71.

So when Nvidia makes a notable move in the AI space, investors pay attention.

In a regulatory filing with the Securities and Exchange Commission on Wednesday, Nvidia disclosed that it acquired stakes in several AI companies, causing their respective stock prices to soar.

Nvidia bought 1.73 million shares of SoundHound AI, which provides voice-controlled AI solutions for enterprises, worth $6.5 million as of Thursday's market close. The company's technology has been deployed at many well-known restaurants, including White His Castle and Jersey His Mike's, to power voice-enabled phones and drive-thru ordering. He is also one of the leading providers of voice AI solutions to car manufacturers, and his client list includes over 20 car brands.

SoundHound wasn't alone. Nvidia has finally confirmed its investment in Arm Holdings. The company holds 1.96 million shares worth approximately $262 million. Arm provides the designs that power some of the world's most widely used central processing units. After two years of planning, regulators have blocked Nvidia and Arm's planned merger in early 2022.

Some saw these acquisitions as an important vote of confidence from Nvidia. As a result, many investors followed suit and rushed into the stock.

The cost is not as high as you think

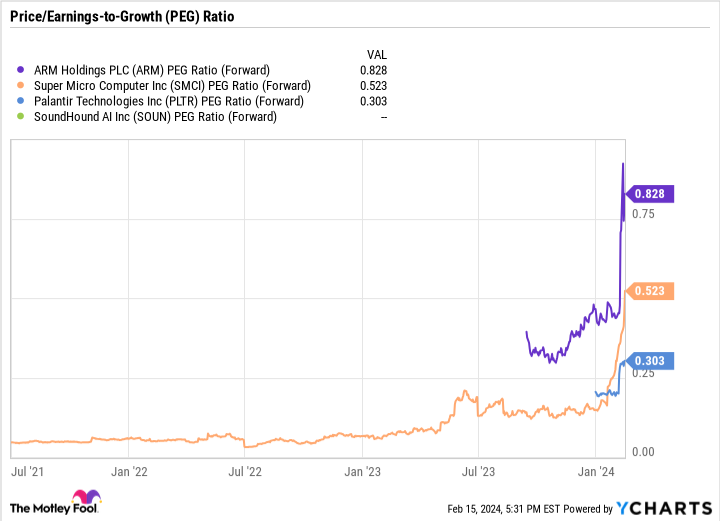

The most common bearish argument in investing in these and many AI stocks is valuation. While that perspective is understandable, it tends to ignore the impressive growth rates of the companies in question. This highlights the limitations associated with using price-to-earnings ratios or sales multiples, especially when they are used alone.

When dealing with high-growth stocks, the price-to-earnings ratio (PEG) is a better measure, as it takes into account the company's earnings growth rate. SoundHound AI isn't profitable yet, so that point is moot. However, in the case of Arm Holdings, Super Micro Computer, and Palantir Technologies, the forward PEG ratios are 0.8, 0.5, and 0.3, all well below the 1 level for undervalued stocks.

From that perspective, Arm Holdings, Super Micro Computer, and Palantir Technologies are not only growing fast, but also cheaper than expected.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palantir Technologies wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 12, 2024

Danny Vena holds positions at Nvidia and Palantir Technologies. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Super Micro Computers. The Motley Fool has a disclosure policy.

Why Palantir Technologies, Arm Holdings, and other artificial intelligence (AI) stocks soared more than 50% in February was published by The Motley Fool.